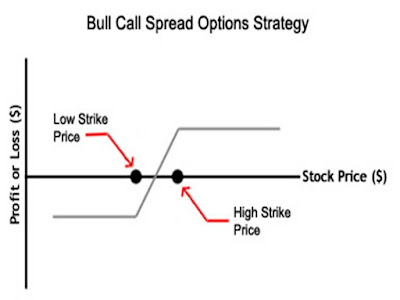

Bull Call Spread

- In a bull call spread strategy; an investor will simultaneously buy call options at a specific strike price and sell the same number of calls at a higher strike price. Both call options will have the same expiration month and underlying asset. This type of strategy is often used when an investor is bullish and expects a moderate rise in the price of the underlying asset.

- Bull call spreads can be implemented by buying an at-the-money call option while simultaneously writing a higher striking out-of-the-money call option of the same underlying security and the same expiration month.