BUY 2 LOTS BANKNIFTY 37500 20 JAN PUT @ 160 TARGET 200

BUY 2 LOTS NIFTY 18500 20 JAN CALL @ 33 TARGET 47-48

FOR LIVE CALLS JOIN US ON WHATSAPP 9039542248

BUY 2 LOTS BANKNIFTY 37500 20 JAN PUT @ 160 TARGET 200

BUY 2 LOTS NIFTY 18500 20 JAN CALL @ 33 TARGET 47-48

FOR LIVE CALLS JOIN US ON WHATSAPP 9039542248

When most

of the world was reminiscing the bittersweet moments of 2021 and anticipating

the arrival of 2022, Dinesh M, a Chennai-based stock trader, was wondering how

he would be able to pay a penalty of ₹12 lakh because of SEBI’s new rules for

options.

For

Dinesh M, the New Year started off with him making a YouTube video begging for

crowd funding through a story that demonstrates how vulnerable retail traders

suddenly are in the Indian stock market.

Dr.

Sanjay, another victim of the same rule, saw ₹35 lakh being wiped out from his

account because of a price difference of 35 paise.

Shweta,

who started trading to overcome depression, experienced another level of stress

induced due to misfiring option trade in the backdrop of SEBI’s new rules that

she was never informed about.

There are

countless stories of retail traders dealing in options who are facing financial

crisis, emotional blow, and havoc in their family life due to new rules

introduced by Securities and Exchange Board of India (SEBI) on October 16 that

came to a head with respect to a Hindalco options trade on the December 30

expiry.

As per

new rules, introduced from November expiry, if Spot price of a stock closes

below a Strike price (means In The Money for Put holders), then a trader

holding Put options of that stock either needs to square off the positions

before expiry or provide the shares. New rules meant option has to be settled

by delivery. Thus, anyone holding In the Money (ITM) option will receive/give

delivery of shares depending on whether one is holding Call or Put options.

For the

uninitiated, put option means the trader is expecting price to go down from

Spot price while Call option means a trader is expecting the stock price to

move up from Spot price (current price). As per theory, buying option has a

limited liability where a trader's loss is restricted to the premium paid while

selling option has unlimited liability. But due to the new rules, even a buyer

of option has to bear unlimited liability in case she could not square off

positions before expiry and option becomes an ITM.

Over a dozen traders who lost a big fortune and are trading through different broking Firms like Zerodha, ICICI Direct, Profitmart, and Upstox. None of them were aware about changes in rules where delivery of shares for ITM trades is made mandatory. Not single retail traders was informed by their broker about the change in SEBI’s rules, nor were they given any warning before they came to face the liability that they now find hard to handle.

STOCK FUTURE CALLS GIVEN IN TODAY'S POST TO CHECK VISIT http://optioncallputtradingtips.blogspot.com/2022/01/blog-post_13.html

HCLTECH ROCKS

ACHIEVED BOTH THE TARGET 1344/1351 BUY GIVEN @ 1337 PROFIT OF 14700

UPL ACHIEVED 1ST TARGET 840 BUY GIVEN @ 830

PROFIT OF 13000

TATASTEEL ACHIEVED 1ST TARGET 1205 BUY GIVEN @

1195 PROFIT OF 4250

NET PROFIT 31950

🔥🔥🍨HAPPY LOHRI🔥🔥🍨

STOCK FUTURE CALL BUY HCLTECH ABOVE 1337 TG 1344/1351 SL 1329

STOCK FUTURE CALL BUY UPL ABOVE 830 TG 840/855 SL 820

STOCK FUTURE CALL BUY TATASTEEL ABOVE 1195 TG 1205/1220 SL 1185

OPTION TIPS GIVEN IN TODAY'S POST TO CHECK VISIT http://optioncallputtradingtips.blogspot.com/2022/01/1-lot-ongc-165-call-2.html

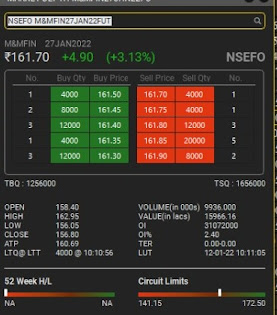

M&MFIN 165 CALL ACHIEVED TARGET 4.5 BUY GIVEN @ 3 PROFIT OF 6000

CHOLAFIN 600 CALL ACHIEVED TARGET 19.5-20 BUY GIVEN @ 15 PROFIT OF 6250

IDFC 68 CALL ACHIEVED TARGET 1.2 BUY GIVEN @ 0.9 PROFIT OF 3000

NET PROFIT 15250

"BUY 1 LOT PNB 45 CALL @ .4 AND 38 PUT @ .4"

BUY 1 LOT M&MFIN 165 CALL @ 3-3.1 TARGET 4.4-4.5

BUY 1 LOT CHOLAFIN 600 CALL @ 15 TARGET 19.5-20

BUY 1 LOT IDFC 68 CALL @ 0.9-1 TARGET 1.2

OPTION CALL PUT TIPS GIVEN IN TODAY'S POST TO CHECK VISIT http://optioncallputtradingtips.blogspot.com/2022/01/option-call-put-tips-for-11-nov-2022.html

IPCALAB 1100

CALL ACHIEVED TARGET 32 BUY GIVEN @ 26 PROFIT OF 2700

NIFTY 18200 CALL ACHIEVED TARGET 40 BUY

GIVEN @ 30 PROFIT OF 1000

PVR 1540 CALL ACHIEVED TARGET 36 BUY GIVEN @

30 PROFIT OF 2442

TATACOMM 1540 CALL ACHIEVED TARGET 42 BUY

GIVEN @ 37 PROFIT OF 2000

NET PROFIT 8142

BUY 1 LOT IPCALAB 1100 CALL @ 26 TARGET 32

BUY 2 LOT NIFTY 18200 CALL @ 30 TARGET 40

BUY 1 LOT PVR 1540 CALL @ 30 TARGET 35-36

BUY 1 LOT TATACOMM 1540 CALL @ 37 TARGET 42