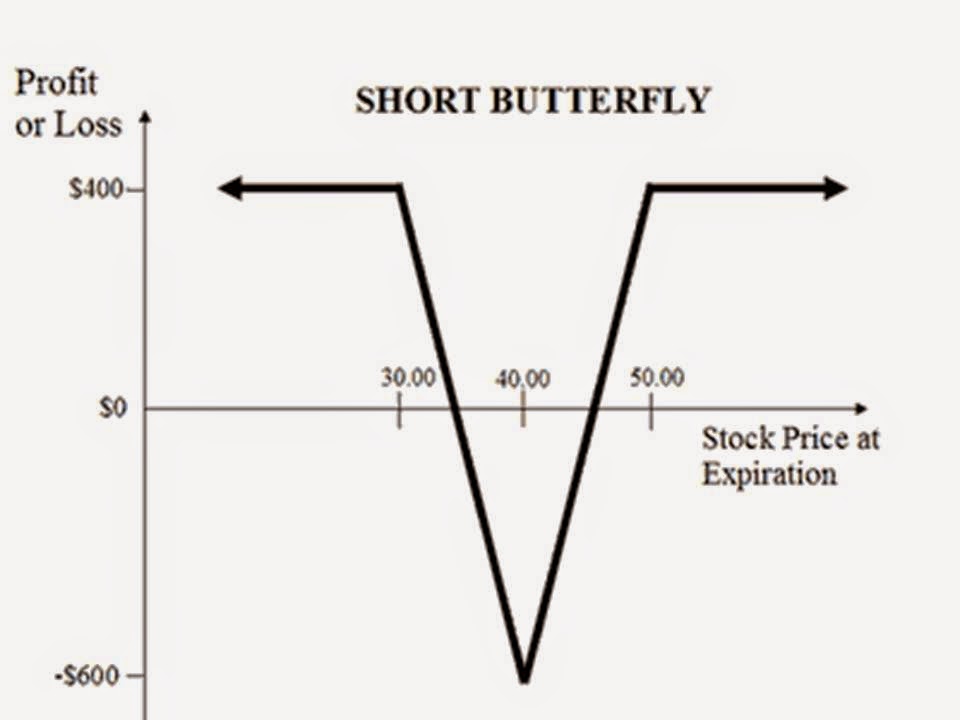

The short

butterfly is a neutral strategy like the long butterfly but

bullish on volatility. It is a limited profit, limited risk options trading

strategy. There are 3 striking prices involved in a

short butterfly spread and it can be constructed using calls or puts.

SHORT BUTTERFLY CONSTRUCTION

Ø

SELL 1 ITM CALL

Ø

BUY 2 ATM CALLS

Ø

SELL 1 OTM CALL

Short Call

Butterfly

Using calls, the short butterfly can be constructed by writing one

lower striking in-the-money call, buying two at-the-money calls and writing

another higher striking out-of-the-money call, giving the trader a net credit

to enter the position.

Limited

Profit

Maximum profit for the short butterfly is obtained when the

underlying stock price rally pass the higher strike price or drops below the

lower strike price at expiration.

If the stock ends up at the lower striking price, all the options

expire worthless and the short butterfly trader keeps the initial credit taken

when entering the position.

However, if the stock price at expiry is equal to the higher

strike price, the higher striking call expires worthless while the

"profits" of the two long calls owned is canceled out by the

"loss" incurred from shorting the lower striking call. Hence, the

maximum profit is still only the initial credit taken.

The formula for calculating maximum profit is given below:

- Max Profit = Net Premium Received - Commissions Paid

- Max Profit Achieved When Price of Underlying <= Strike Price of Lower Strike Short Call OR Price of Underlying >= Strike Price of Higher Strike Short Call

No comments:

Post a Comment

Thank u For Reading Our blog For More Details Contact 9039542248